what percent of tax is taken out of paycheck in nj

What is the NJ income tax rate for 2020. Only the very last 1475 you earned.

Here S How Much Money You Take Home From A 75 000 Salary

The top federal marginal rate is 37 meaning a single taxpayer with no other income dependents or tax deductions like charitable giving would need to set aside an.

. Your employer uses the information that you provided on your W-4 form to. Total income taxes paid. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

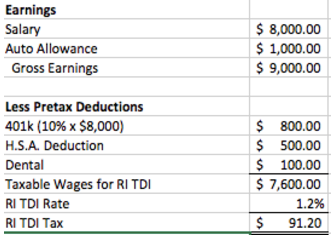

That is unless your regular household income already places you in the top tax bracket prior to winning. However they dont include all taxes related to payroll. Dear There is no set percentage for NJ state withholding it works like Federal withholding---meaning that there are withholding formulas and generally the more money earned in a pay.

You still need to pay federal income tax on top of this. Just enter the wages tax withholdings. This New Jersey hourly.

FICA taxes consist of Social Security and Medicare taxes. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. The top federal income tax rate is 37 and this year applies to income above 539900 for individual tax filers and.

Assuming the state already. New Jersey Income Tax Calculator 2021. If you own your residence 100 of your.

The tax rate on wages over 1000000 and up to 5000000 for the State of New Jersey has changed from 213 percent to 118 percent for all tax tables. New Jersey income tax rate ranges from 140 to 1075 and there are also three types of payroll taxes. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Your average tax rate is 1198 and your marginal tax. Any wages earned above 147000 are exempt. Federal income taxes are also withheld from each of your paychecks.

New Jersey paycheck calculator. Both employee and employer shares in paying these taxes. Use the New Jersey bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method.

In that case all of it is taxed at 37 percent. Total income taxes paid. For Social Security withhold 62 of each employees taxable wages until they have earned 147000 for the year.

How much do you. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. For a single filer the first 9875 you earn is taxed at 10.

Dont worry we did the math for you. This can be calculated using a tax. All in all you would likely owe 34383585150 in taxes.

This is the amount of. How Your New Jersey Paycheck Works. NJ Taxation Effective January 1.

A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. New Jersey has a special tax program that allows all residents to deduct as much as 100 of their property tax burden from their taxable income. Starting with tax year 2018 you can now deduct up to 15000 of property.

1 day ago2022 federal income tax brackets for single filers. FICA taxes are commonly called the payroll tax. Amount taken out of an average biweekly paycheck.

If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. What is the NJ tax rate. As mentioned above property taxes are usually tax deductible on your New Jersey income tax return.

19 hours agoHowever more would likely be due to the IRS at tax time.

What Taxes Will I Pay If I Work In Manhattan And Live In Nj

New Jersey Paycheck Calculator Smartasset

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Why Is N J Leaving 415m On The Table For Needy Children Editorial Nj Com

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

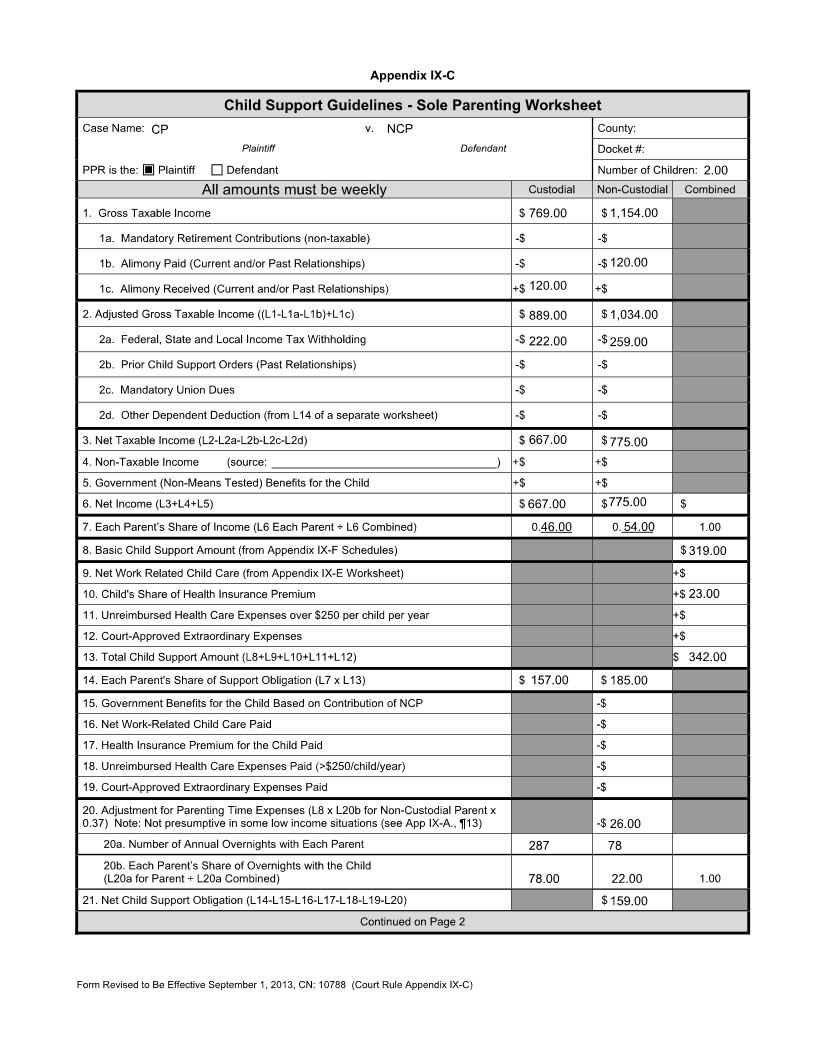

How Much Child Support Will I Pay In New Jersey

Nj Division Of Taxation Employer Payroll Tax

New Jersey Retirement Tax Friendliness Smartasset

State Withholding Form H R Block

A Complete Guide To New Jersey Payroll Taxes

New Jersey Nj Tax Rate H R Block

Alabama Hourly Paycheck Calculator Gusto

Here S The Bad News 5 Tax Experts Are Delivering To New Jersey Residents Plus Some Tips Nj Com

How Much Taxes You Will Pay On A 64 000 Salary In Nyc

New Jersey Income Tax Calculator Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

Filing Taxes In Two States Working In Ny Living In Nj Priortax

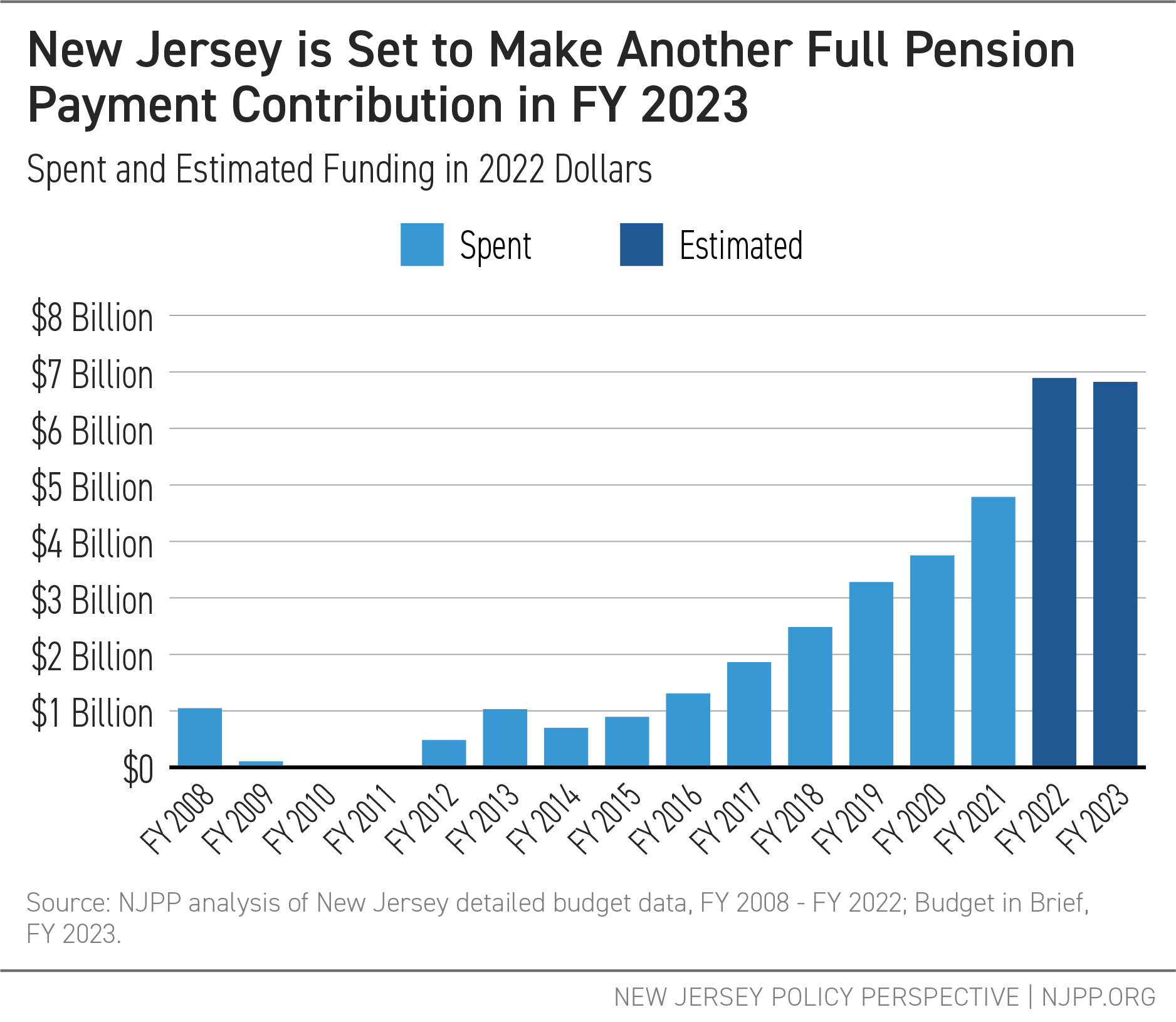

Breaking Down Governor Murphy S Fy 2023 Budget Proposal New Jersey Policy Perspective